child tax portal update dependents

COVID Tax Tip 2021-167 November 10 2021. That comes out to 300 per month through the end of 2021 and 1800 at tax time next year.

Child Tax Credit Applications Eligibility Amount And Deadline Marca

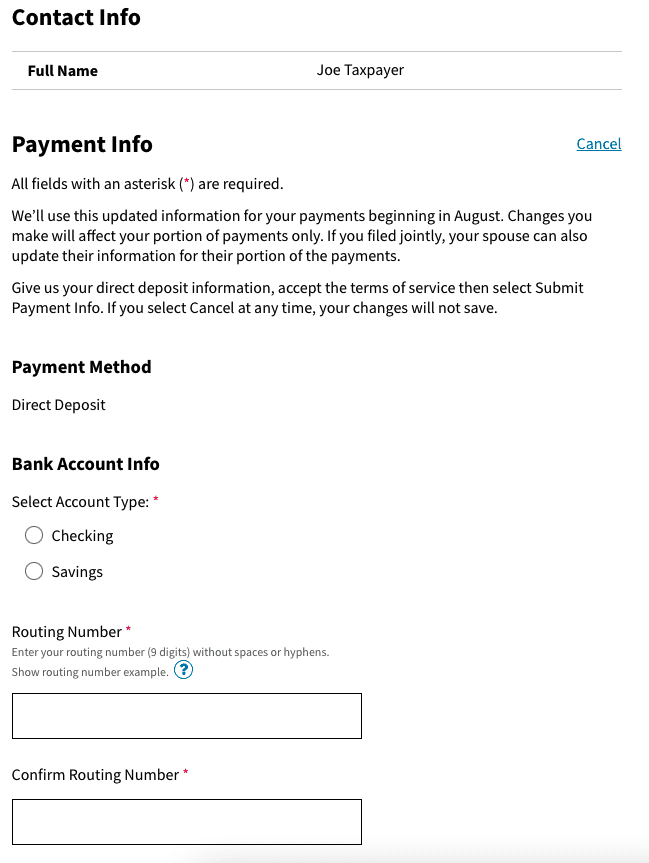

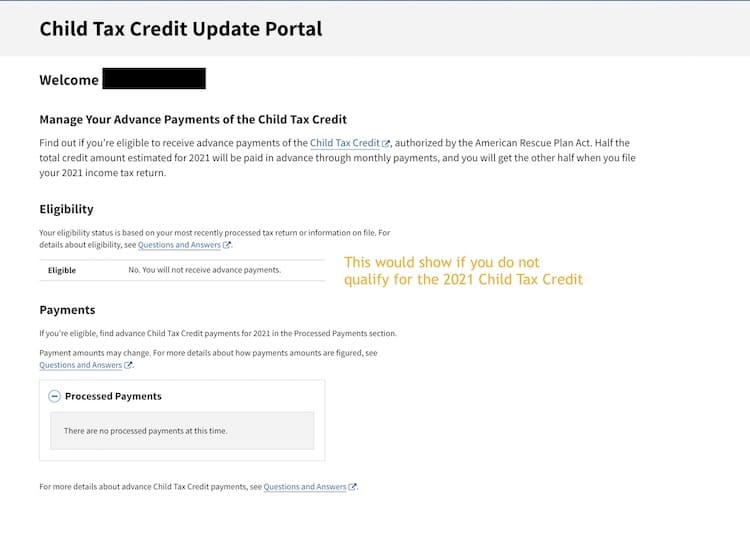

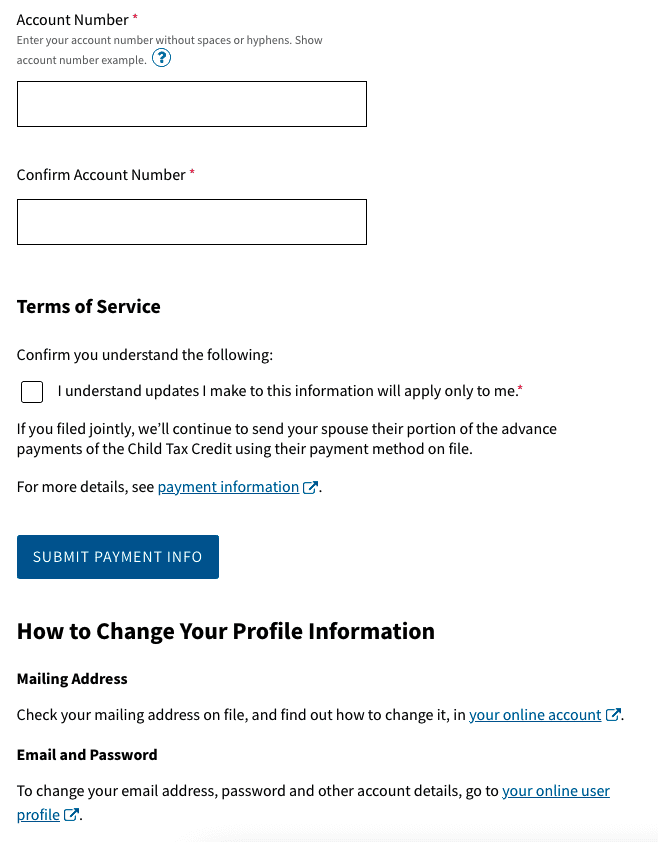

The IRS recently launched a new feature in its Child Tax Credit Update Portal allowing families receiving monthly advance child tax credit payments to update their income.

. Either your qualifying child or qualifying relative. Soon people will be able update their mailing address. Max refund is guaranteed and 100 accurate.

Tax Plug detroittaxqueen The News Girl lisaremillard Gavin Larnardgavinjlarnard Tax Pro Sergeorangecoasttax File your taxes todayingramtaxes. Child tax credit portal update dependents Tuesday March 29 2022 To complete your 2021 tax return use the information in your online account. The IRS will add more features to the Child Tax Credit Update Portal through the summer and fall.

By fall people will be able to use the tool to update changes to family status and income. Half will come as six monthly payments and half as a 2021 tax credit. The Child Tax Credit Update Portal lets you opt out of receiving this years monthly child tax credit payments.

The maximum credit for other dependents is 500 and it has the same phase-out. This means that instead of receiving monthly payments of say 300 for your 4-year. In order to claim someone as your dependent the person must be.

This means that instead of receiving monthly payments of say 300 for your 4-year-old you can wait to file a 2021 tax return in. Free means free and IRS e-file is included. The IRS has created the Child Tax Credit Update Portal which allows you to update your bank account for direct deposit.

The Child Tax Credit Update Portal allows you refuse to receive monthly child tax credit payments for that year. Half of the money will come as six monthly payments and. That amounts to 300 per month through the end of.

The IRS will pay 3600 per child to parents of young children up to age five. The IRS will pay 3600 per child to parents of children up to age five. The Child Tax Credit Update Portal allows parents to opt out of the CTC which could be useful for divorced parents to avoid such an issue.

Families should enter changes by November 29 so the changes are reflected in the December payment. Ad File a federal return to claim your child tax credit. By fall people will be able to use the tool to update.

More information is on the Advance Child Tax Credit Payments in 2021 page of IRSgov. Unmarried or if married not filing a joint return or only filing a joint return to claim a refund of income tax withheld or estimated tax paid. The expansion increased the tax credit for child dependents by almost double.

The Child Tax Credit Update Portal lets you opt out of receiving this years monthly child tax credit payments. The amount changes to 3000 total for each child ages six through 17 or 250 per month and 1500 at. National or a resident of Canada or Mexico.

Simple or complex always free. The IRS will add more features to the Child Tax Credit Update Portal through the summer and fall.

How Does Child Tax Credit Work For Divorced Parents And Other Non Traditional Families The Washington Post

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Child Tax Credit Dates Next Payment Coming On October 15 Marca

Explaining The New 2022 Child Tax Credit And How To Claim Familyeducation

Are Child Tax Credit Payments Taxable Gobankingrates

Didn T Get Your Child Tax Credit Here S How To Track It Down Gobankingrates

Stimulus Update What To Do If You Haven T Received Your Child Tax Credit Payment Yet

Irs Announced Monthly Child Tax Credit Payments To Start July 15 Forbes Advisor

Child Tax Credit And Advance Child Tax Credit Payments

2021 Child Tax Credit Steps To Take To Receive Or Manage

Dependent Children 2021 Tax Credit Jnba Financial Advisors

2021 Child Tax Credit Steps To Take To Receive Or Manage

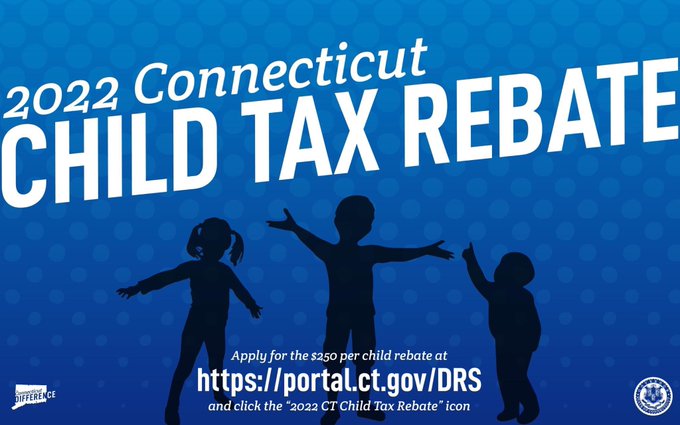

Child Tax Credit 2022 Payments Of 750 Available For Americans See If You Have The Qualifications To Apply

Dependent Children 2021 Tax Credit Jnba Financial Advisors

2021 Child Tax Credit Steps To Take To Receive Or Manage

Don T Toss These 2 Important Stimulus And Child Tax Credit Letters From The Irs

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

How The 2021 Child Tax Credits Work Updated June 21st 2021 The Learning Experience